U.S. Renewable Electricity Market

- How is the U.S. renewable electricity market organized?

- How do the mandatory and voluntary markets work together to grow U.S. renewable energy supply?

- How do REC prices vary across voluntary and mandatory renewable energy markets?

How is the U.S. renewable electricity market organized?

The U.S. renewable electricity market comprises those that are required to buy renewable electricity from those that want to buy it voluntarily. Whether you are required to buy renewable electricity or not, buyers generally want to make a claim—to publically state or disclose that they are buying or using renewable energy.

Mandatory markets exist because of policy decisions, such as state renewable portfolio standards (RPS). Such standards require some electric service providers to have a minimum amount of renewable energy in their electricity supply. Often, these policy decisions specify eligible energy resources or technologies and describe how electricity service providers must comply. In these markets, policymakers may often consider other criteria (e.g., economic or jobs growth) other than environmental attributes in setting mandatory market resource and technology eligibility criteria. Utilities use renewable energy certificates (RECs) to make claims of compliance under mandates.

Voluntary markets, also referred to as green power markets, are driven by consumer preference for certain types of renewable energy. Voluntary markets allow a consumer to go above and beyond what mandatory policy decisions require and to reduce the environmental impact of their electricity use. Voluntary green power products must offer a significant benefit and value to buyers to be successful.

How do the mandatory and voluntary markets work together to grow U.S. renewable energy supply?

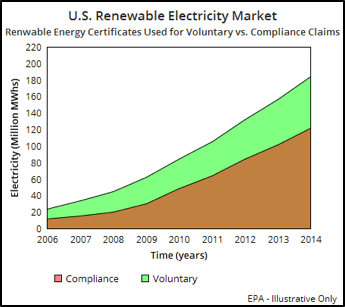

It can be helpful to think of the mandatory market as a natural floor to the market, representing what will minimally occur with respect to renewable energy supply, whereas the voluntary market theoretically represents an unlimited opportunity above this market floor, which is only constrained by voluntary demand and capped by total demand for electricity.

It can be helpful to think of the mandatory market as a natural floor to the market, representing what will minimally occur with respect to renewable energy supply, whereas the voluntary market theoretically represents an unlimited opportunity above this market floor, which is only constrained by voluntary demand and capped by total demand for electricity.

In order to ensure that both markets work together to increase supply, it is important that the voluntary market is separate from and incremental to the mandatory market. A purchase made by an individual or organization in the voluntary market must be incremental to any renewable generation claimed under the mandatory market. This concept is often referred to as “regulatory surplus,” and helps ensure that double claims are avoided on the same megawatt-hour of renewable energy generation.

How do REC prices vary across voluntary and mandatory markets?

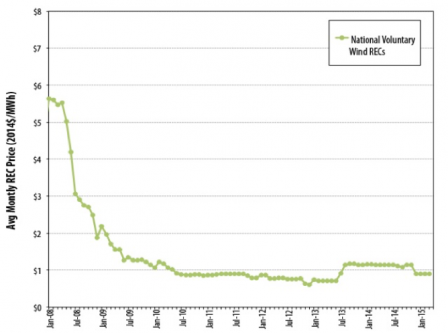

The voluntary market operates on a supply and demand balance, with REC prices correlated to the amount a voluntary buyer is willing to pay for a product, relative to the available supply of that product. In theory, the voluntary market operates on a supply and demand balance that involves little, if any, overt market distortion on pricing.

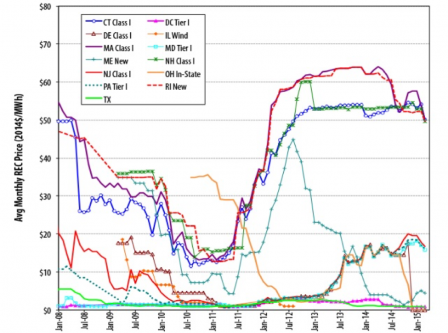

In contrast, regulatory bodies tend to interject market price distortion into mandatory markets by setting targets and penalties (e.g., alternative compliance payments) that regulated entities (e.g., utilities) must pay in the absence of meeting the regulatory mandate. In some cases, these regulatory targets and associated penalties are resource specific, as is often the case for solar. As a consequence, renewable developers supplying the mandatory market not only know how much supply a regulated entity must buy, but also how much they are willing to pay in order to avoid the penalty of the alternative compliance payment. State policy driven markets are also often supply constrained due to geographical and resource limitations. Therefore, pricing of RECs that supply mandatory markets tend to hover just below the alternative compliance payment cost for that market.

The following two graphics represent the relative variations found across and within the voluntary and compliance markets. The voluntary market chart represents wholesale, national wind RECs pricing. These graphics should be viewed as illustrative, as pricing in markets can change over time.

Source: http://apps3.eere.energy.gov/greenpower/markets/certificates.shtml?page=5, U.S. Department of Energy, Green Power Network.