Financial Responsibilities for Underground Injection Well Owners or Operators

On this page:

- Federal regulations

- Qualifying financial instruments

- Roles and responsibilities

- UIC director's financial responsibility review procedures

- Guidance documents

- Additional documents

To protect underground sources of drinking water (USDWs), owners or operators are required to maintain financial responsibility for all classes of permit-authorized wells. Financial responsibility requires owners or operators to set aside financial resources sufficient to maintain and plug and abandon wells consistent with approved closure plans.

Financial responsibility requirements protect:

- USDWs from endangement

- The public from bearing well abandonment costs if an owner defaults on the permit requirements

Federal regulations

Federal regulations require that an owner or operator maintain financial responsibility for rule authorized injection wells as follows:

- Class I, Class II, and Class III wells at 40 CFR 144.28(d)

- All classes of permit-authorized wells at (40 CFR 144.52(a)(7))

- Additional requirements for Class I hazardous waste and Class VI geologic sequestration wells at:

- 40 CFR 144 Subpart F for Class I wells

- 40 CFR1460825 for Class VI wells

Rules for Class I hazardous waste injection wells differ from other well classes. These wells are:

- Regulated under both the Safe Drinking Water Act and the Resource Conservation and Recovery Act

- Described in rule with financial instrument, timing, and required payment specified.

Class II financial responsibilities are addressed in guidance, which provides recommendations on financial instruments. Unlike the requirements for other well classes, financial responsibilities for Class II wells are recomendations and non-binding. States with primacy may have additional financial responsibility requirements that owners or operators must follow.

Class VI wells have:

- Minimum requirements in rule

- Supplemental recommendations in guidance

Review the federal financial responisbility requirements for all classes of permit authorized wells

Review the additional federal financial responisbility requirements for Class I wells

Review the additional federal financial responsibility requirements for Class VI wells

Qualifying financial instruments

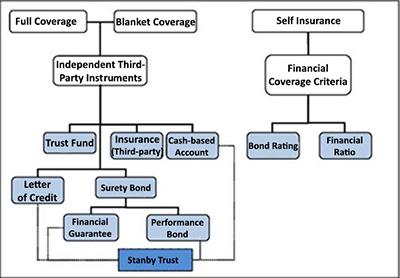

Two broad categories of financial instruments are available to owners or operators.

- Independent third-party instruments, such as surety bonds and letters of credit are contracts between the owner or operator and a third-party provider.

- Self insurance provides that owners or operators guarantee financial responsibility by demonstrating the company’s profitability and stability. Qualifying instruments may differ among well classes and state UIC programs.

Two main types of coverage are available.

- Full coverage: The value of a financial responsibility instrument is at least equal to the current cost estimate for the covered activities.

- Blanket coverage: An instrument can cover multiple wells at a value less than the anticipated cost on a per well basis. Blanket coverage is offered by many states. The required value of the financial responsibility instrument typically depends on the number and depth of wells covered.

Typical financial responsibility instruments for the UIC program.

Typical financial responsibility instruments for the UIC program.

Roles and responsibilities

| Role in the Financial Responsibility Process | Responsibility |

|---|---|

| Well Owner or Operator |

|

| UIC Director |

|

UIC director's financial responsibility review procedures

The UIC director must complete several steps to fully review a financial responsibility demonstration including:

- Assessing the completeness and accuracy of the demonstration

- Evaluating the financial stability of the independent third party, if applicable

- Requesting additional information from the owner or operator, if necessary

- Evaluating and approving the demonstration

- Evaluating the demonstration’s success

Guidance documents

EPA has developed guidance documents to help with the implementation of financial responsibility regulations. The guidance documents provide:

- Additional information about financial responsibility requirmenents

- Alternatives that exceed the minimum regulatory requirements

View additional financial responsibility guidance documents.

Additional documents

Checklists are available to guide initial and annual regulatory reviews of financial responsibility demonstrations. The checklists:

- Help users ensure consistency

- Are useful in tracking key information, such as documentation and financial strength criteria

Review the checklists to guide initial and annual regulatory reviews.