Renewable Identification Numbers (RINs) under the Renewable Fuel Standard Program

RIN Lifecycle

Click the image to view a larger version.

Click the image to view a larger version.

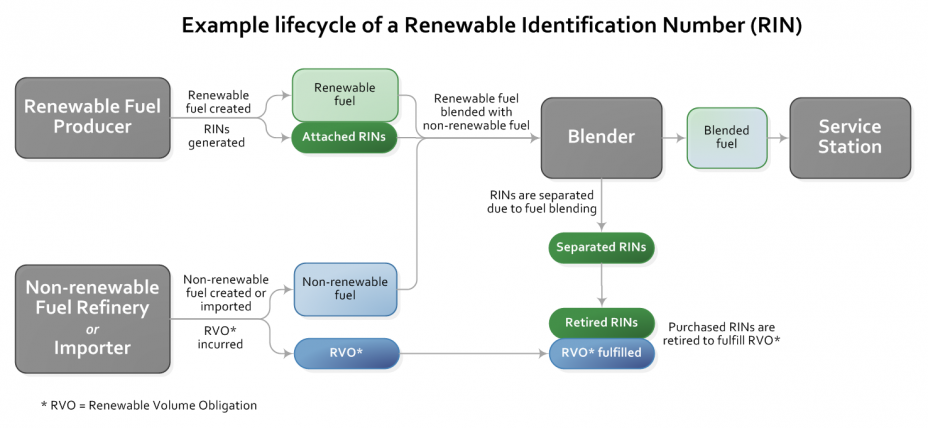

Renewable identification numbers (RINs) are credits used for compliance, and are the “currency” of the RFS program.

- Renewable fuel producers generate RINs

- Market participants trade RINs

- Obligated parties obtain and then ultimately retire RINs for compliance

RINs can be traded in two forms:

- Assigned RINs - directly associated with a batch of fuel and that travel with that batch of fuel from party to party. Purchase obtain both the renewable fuel and RINs together.

- Separated RINs - formerly assigned with a batch of fuel, but are no longer assigned to a batch. Purchase only the RIN.

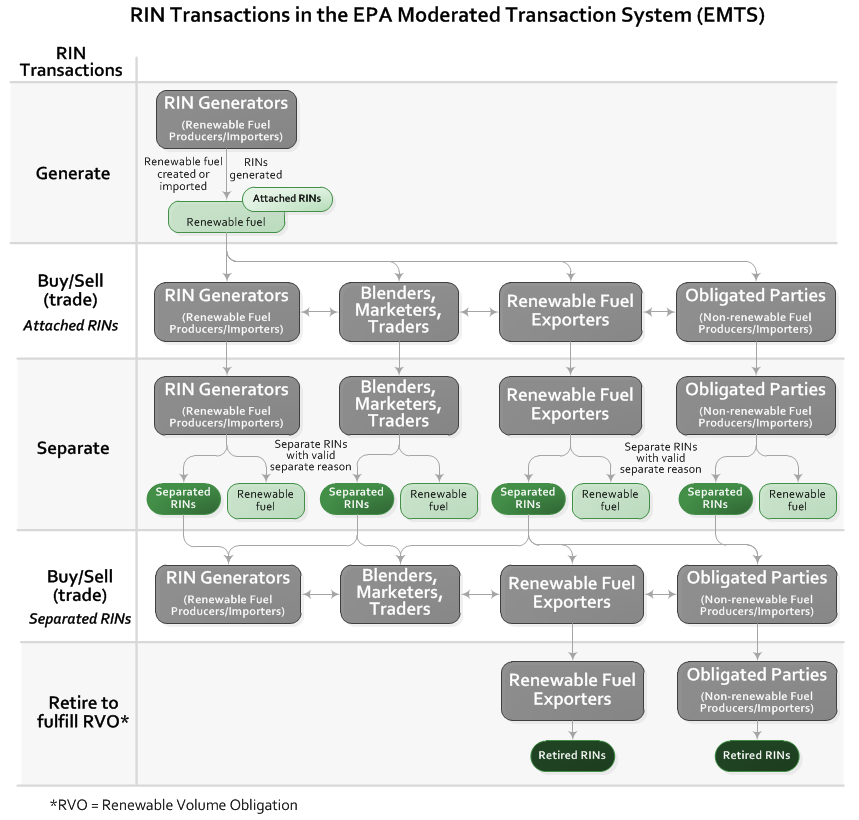

Examples of typical RIN transactions include:

- Generate - when a fuel is produced, a RIN is generated

- Buy - when an assigned/separated RIN is bought/traded to by a buyer from a seller

- Sell - when an assigned/separated RIN is sold/traded by a seller to a buyer

- Separate - when a RIN is separated from the fuel to which it was originally assigned

- Retire - when a RIN is used to demonstrate compliance, or required to be retired for other purposes

Market Participants

The regulations outline the following types of RIN market participant categories:

- Obligated parties (refiners and importers of gasoline or diesel)

- Renewable fuel exporters

- Renewable fuel producers

- Registered RIN market participants

Participants include both domestic and foreign companies. A company may fall under one or more categories and can change from year to year based on their trading or business activities.

RIN Transactions in EMTS

EPA moderated transaction system (EMTS) is a database of record for all transactions involving RINs.

- Parties enter into a trade agreement outside of EMTS

- Each of the trading partners then enter into EMTS a separate record (“buy”/”sell”)

- EMTS matches the trades; if the QA check is passed RINs are transferred between accounts

Companies maintain RIN accounts by D-codes and RIN year (typically called “vintage” year, or the year in which the RIN was generated). RINs are retired for compliance by obligated parties and exporters based on their RVO.

- Obligated parties typically only retire RINs after the end of the compliance year (or by March 31st)

- Exporters have to retire RINs for compliance within one month of the export event (this was a recent change in 2014).

RINs not retired for compliance can be carried over into the next compliance year. RINs are only good for satisfying obligations for the current compliance year or the following compliance year. For example, 2012 RINs can only be used for 2012 and 2013 compliance years. After that, the RINs “expire” or can no longer be used for compliance purposes.