Grants Management Training for Non-Profit Applicants and Recipients

EPA’s Vision and Overview of This Course

EPA is committed to ensuring that its grants programs meet the highest management and fiduciary standards, and further the agency's mission of protecting human health and the environment.

This web-based training is designed to help non-profit recipients of EPA grants and cooperative agreements (grants or grant agreements) manage their grants in a manner that assures EPA meets this vision. (When we use the term grant in this training, it means both grants and cooperative agreements. Grants are also sometimes called assistance agreements).

EPA’s regulation that applies to grants is found in Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and Other Non-profit Organizations, (see 40 CFR Part 30). These administrative requirements are the nearly identical to those for all other federal agencies, although it is written for EPA.

The training is organized generally consistent with EPA’s grant making process from before EPA awards a grant through the close out of the grant.

- Part 1 – Applying for a Grant

- Part 2 – Demonstrating Management System Capability

- Part 3 – Accepting a Grant

- Part 4 – Managing Grant Activities

- Part 5 – Closing the Grant

You will apply for an EPA grant either in response to a competitive request for grant applications or proposals or by submitting an unsolicited proposal. EPA selects most applications for award through its competitive requests.

If you are awarded an EPA grant you will then manage the grant activities to completion, including requesting payments, purchasing goods and services, keeping records, submitting reports, and closing the grant when it is complete.

While this is a training course, it may also be used as guidance for various activities as your organization manages an EPA grant project. For example, it provides specific guidance for purchasing goods or services necessary for your project and preparing necessary reports related to your project.

Part 1: Applying for Grant

Finding a Grant Opportunity

It is EPA policy to promote competition in the award of grants to the maximum extent practicable and to assure the competitive process is fair and open and that no applicant has an unfair competitive advantage. This policy is established in EPA’s Policy for Competition of Assistance Agreements.

There are several places to find current EPA funding opportunities in which your organization may be interested. These include:

- The federal government’s grant solicitation website called Grants.gov. You may search all agencies’ solicitations or the solicitations of a particular agency.

- EPA solicitations

Some of the solicitations listed may be closed, so be certain those you are interested in are still available.

- You can also find EPA’s solicitations Open Announcements.

Most of these solicitations are synopses of detailed solicitations to which you must respond. Synopses generally include links to the complete solicitation.

You may refer to the Catalog of Federal Domestic Assistance (CFDA) to obtain listings of all Federal programs, including those of EPA, of course. The catalogue does not, however, have links to specific solicitations.

If EPA changes the requirements of a solicitation before the application deadline, EPA will notify all potential applicants in the same manner that the original announcement was announced.

Reviewing Solicitations

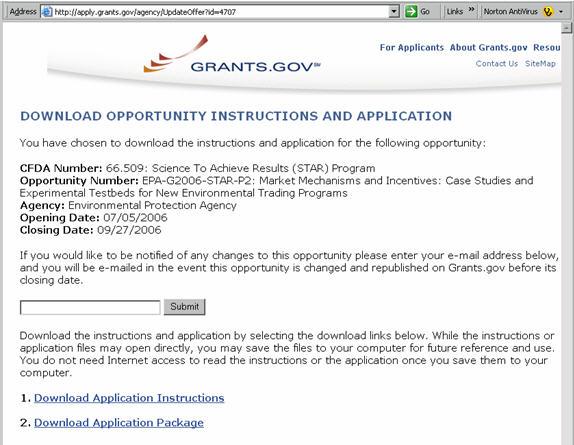

When you select a particular solicitation on Grants.gov, it will look like this:

This document is a synopsis and, within it, you will find a link to the full announcement. Click on this link to determine whether the funding opportunity you are reviewing is consistent with the expertise, interests, and mission of your organization.

The announcement explains in detail the information you will have to assemble to respond to the solicitation. The requirements that apply to EPA and establish the requirements for the contents of a full solicitation are found at:

Whitehouse Policy Directive: Office of Federal Financial Management Policy Directive on Financial Assistance Program Announcements (PDF) (11 pp, 192 K, About PDF)

In some cases you will be required to submit all forms and documents with your response to the solicitation and in others you may be required to submit only your proposal (or statement of work) and the Applications for Federal Assistance (SF-424) found on the EPA Grantee Forms Page.

Downloading the Application

Clicking the how to apply button on the previous screen brings you to the following screen:

You should download the application instructions and the application package. This will help you determine the nature of the information you will be asked to provide. There are several steps for you to complete, however, before you are ready to submit the application.

Reviewing the Solicitation

Each full solicitation contains the programmatic description of the funding opportunity and sufficient information to help you make an informed decision about whether to submit a proposal. You can view a sample solicitation here: sample solicitation.

The solicitation will include information on:

- Eligibility: The eligibility section see section III in the sample solicitation will enable your organization (to) determine whether it is eligible to compete. If you are a non-profit organization (,) and non-profit organizations are not listed among the eligible applicants you may not apply.

- Environmental Results: Environmental Results Under Assistance Agreements, EPA Order 5700.7 requires all solicitations to describe the link between the anticipated work under selected grant applications and EPA’s Strategic Plan and Government Performance and Results Act architecture. It must also list expected outputs and outcomes. (See Section I in the sample solicitation).

- Evaluation Criteria: The solicitation will include the evaluation criteria and process EPA will use in selecting among applicants. This will allow you to better tailor your proposal to EPA’s requirements (see Section IV of the sample solicitation). The criteria will assure that review panel members will be able to differentiate the quality of proposals. EPA will not make selections based on undisclosed criteria.

The solicitation will also ask you to describe such things as your (organizations):

- Previous performance on past projects.

- History of submitting required reports.

If you determine your organization is eligible to compete for an award and has a project consistent with EPA’s needs, you must develop a detailed proposal describing the nature of your proposed project.

Preparing a Proposal

The most important part of your assistance application is the proposal. The proposal must include all information required under the solicitation. It should clearly address the evaluation criteria and explain how your proposed project meets the criteria in the solicitation. It should clearly explain what you expect your project to accomplish and it should make clear why your proposal is worthy of funding. EPA has developed a document that provides Tips on Writing a Grant Proposal, which may help assure your proposal is complete.

The proposal must include a proposed budget and you should assure the scope of your project is consistent with the budget and the applicable Office of Management and Budget (OMB) Cost Principle Circulars (see preparing a budget and part 2 - demonstrating management system capability for further information). If EPA funding is not adequate to complete your project, EPA has no obligation to provide additional funding.

EPA will consider all information in your proposal, along with information EPA may have from other sources concerning your past performance, your management capability, and your responsiveness to the requirements of the solicitation in evaluating whether EPA will select your proposal for an EPA grant.

Achieving Environmental Results

EPA is committed to linking its grants to EPA performance goals. To accomplish this EPA’s grant solicitations require that grant proposals discuss environmental results and how they will be measured. In response, grant applicants must ensure that their work plans contain defined outputs and, to the maximum extent practicable, defined outcomes. These requirements are established in Environmental Results Under Assistance Agreements, EPA Order 5700.7.

An output is an environmental activity, effort, or associated work products related to an environmental goal or objective that will be produced or provided over a period of time. Outputs may be quantitative or qualitative, but must be measurable during your grant project period.

An outcome is the result, effect, or consequence that will occur as a result of an environmental activity under your grant. Outcomes may be environmental, behavioral, health-related, or programmatic; must be quantitative; and may not necessarily be achievable within your grant’s project period.

Your grant proposal must make clear the outputs and outcomes you expect to achieve from your grant project and how you will measure progress towards achieving them (see Section I in the sample solicitation). The grant solicitation will include ranking criteria for evaluating your plan for tracking and measuring progress toward achieving the expected outputs and outcomes.

In addition, the grant solicitation will include ranking criteria for evaluating your past performance in reporting on outputs and outcomes.

Preparing a Budget

You must complete a budget for your application. You will submit a budget for a non-construction project on standard form 424 A. Most applicants will use schedule B of SF 424 A. If the project for which you are developing an application is based on a solicitation, you will find the SF 424 A in the list of documents that must be completed when you download an application for a project at: Grants.gov

In developing the budget, you should consider the amount EPA has stated is available in the particular solicitation to which you are responding and you must base your budget on financial information from your accounting system. For example, salaries must be based on the estimated number of hours each employee will spend on project work considering current salaries and any projected salary increases during the project. Indirect costs rates must be supported by your accounting system and your indirect cost basis must be the same as that used for other projects, except it must not include costs that are unallowable under:

Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230)

(Your accounting system may also be evaluated before award. The evaluation process will be covered in another part of this training.)

Finally, you should assure the scope of your project is consistent with the budget. If EPA funding is not adequate to complete your project, EPA has no obligation to provide additional funding.

Submitting an Application

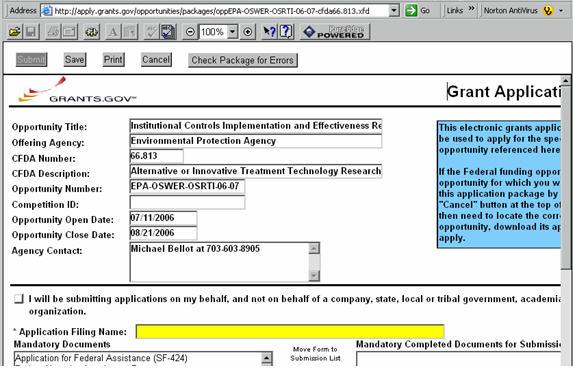

When you have developed all information required by the solicitation, you may submit the application. You may access the application submission page by going back to the solicitation at Grants.gov under which you are applying and follow the links to the grant application package that looks like the following:

You must now make the package final by adding the required information and moving the attached documents to the completed side.

Generally, to be considered timely, applications must be postmarked by the U.S. Postal Service, hand-delivered, or electronically delivered to the Agency, or include official delivery service documentation indicating EPA acceptance from a delivery service, on or before the deadline date published in the request for applications or request for initial proposals. The request will be clear on how EPA will handle applications or proposals that are received after the deadline.

If you submit the application electronically, Grants.gov will notify EPA that your application is available for review.

Evaluating Applications

Generally, an EPA panel evaluates competitive applications and proposals. However, panels also include employees of other federal agencies and non-federal personnel, but EPA staff must make final decisions on the relevance of particular proposals to program needs and the selection of recipients. EPA will assure that individual reviewers do not have a conflict of interest with regard to a particular applicant or application.

The panel will review and rank or prepare a list of qualified and unqualified proposals or applications based on the evaluation criteria and relative weights included in the solicitation. (In some cases, the solicitation will ask applicants to submit initial proposals for evaluation. EPA will rank the initial proposals and only those applicants whose proposals are selected for possible funding will be asked to submit final proposals and applications. The panel typically provides its recommendations to an EPA approval official. The EPA approval official will determine, based on recommendations from the panel, which applications to approve.

Ranking Applications

Each solicitation describes the process that will be used to rank responding applications and applicants.

EPA tailors the ranking criteria to the nature of the projects being competed. The criteria represent areas of importance and emphasis to be considered in the selection process, and support meaningful and fair comparisons among competing applicants.

If criteria vary in importance, as most do, the solicitation will state the relative weights, percentages, or other means used to distinguish them (e.g., point scores for the factors; or factors may be listed in descending order of importance). If the relative importance of each criterion is not identified they all will be of equal value (e.g., if an announcement has 4 evaluation factors and no value is attributed to any of them, then each will be considered of equal value).

The solicitation will also:

- Include any evaluation criteria required by law (e.g., CERCLA 104(k)(5)(C) for Brownfields grants), regulation, or agency policy (e.g., Environmental Results Under Assistance Agreements, EPA order 5700.7 and programmatic capability.)

- Identify any program policy or other factors, other than the technical evaluation criteria, that may be considered in the award selection process (e.g., geographical diversity, programmatic priorities, program funding balance).

Notifying Unsuccessful Applicants

EPA will notify you in writing or by e-mail, if your organization’s application was not selected for funding. The notice will explain that your application was either:

- Determined to be ineligible based on the applicable statute, regulation, or announcement requirements; or

- Determined to be ineligible based on threshold eligibility criteria in the solicitation (e.g., your organization is not an eligible entity or your proposed project was not eligible to be funded), or

- Not selected for award based on their ranking after evaluation against the ranking and selection criteria in the solicitation.

The notification will advise that you may request a debriefing to explain more fully the reasons your application was not selected or was determined to be ineligible. If you decide to do so, you must request the debriefing within fifteen calendar days after you receive the notification.

EPA may do the debriefings orally or in writing, although oral debriefings are preferred. EPA will conduct oral debriefings (perhaps by telephone) at a mutually agreeable time and place as soon as practicable after you submit your request. EPA will provide written debriefings as soon as practicable after receiving your request.

Disputing Grant Competition Decisions

After a debriefing, under the circumstances discussed below, you may file a dispute under Appendix A to EPA’s Policy for Competition of Assistance Agreement, EPA Order 5700.A1 with the Grants Competition Disputes Decision Official (GCDDO). The Grants Competition Disputes Decision Official (GCDDO) is an EPA employee who was not involved in the grant competition and is from outside of office that conducted the competition. For headquarters competitions, the Director, Office of Grants and Debarment (OGD), will select the Grants Competition Disputes Decision Official (GCDDO). For regional competitions, the Regional Award Official will generally designate the Grants Competition Disputes Decision Official (GCDDO).

EPA must receive your written dispute within fifteen calendar days of the debriefing date. Your dispute filing must include a detailed statement of the legal and factual basis for the dispute, the remedy you are seeking, information on how to communicate with your organization (e.g., phone and fax numbers and e-mail addresses), and any relevant documentation. Disputes may only be filed after a debriefing; the Grants Competition Disputes Decision Official (GCDDO) will dismiss disputes filed before, or in the absence of, a debriefing.

Furthermore, the Grants Competition Disputes Decision Official (GCDDO) is only required to consider disputes on the following grounds:

- You do not agree with the determination that your organization or your proposed project is ineligible for funding based on the applicable statute, regulation, or announcement requirements; or

- You do not agree with the determination that your organization is not eligible for award consideration because your application or project did not meet the threshold eligibility requirements contained in the announcement.

Generally, the Grants Competition Disputes Decision Official (GCDDO) will deny, without review, disputes based on scoring issues.

Deciding Grant Competition Disputes

The Grants Competition Disputes Decision Official (GCDDO) will consult with the Program Office, the Office of General Counsel, and the grants competition advocate and will then determine whether it is in the agency’s best interest to delay grant awards pending resolution of the dispute.

The Grants Competition Disputes Decision Official (GCDDO) will establish the process and schedule for resolving your dispute and advise you and the affected EPA Program Office. The GCDDO may request you or the program office to submit additional information or meet with you or the Program Office by phone or in person. The Grants Competition Disputes Decision Official (GCDDO) will assure that you have reasonable access to relevant EPA records consistent with the standards contained in the Freedom of Information Act. EPA will not disclose materials exempt from disclosure under the Freedom of Information Act.

After reviewing all of the information relevant to the dispute, the Grants Competition Disputes Decision Official (GCDDO), after consultation with the grants competition advocate and concurrence of the Office of General Counsel, will timely issue a final written decision regarding the dispute. The decision will constitute final agency action and is not subject to further EPA review.

Quiz:

Part 2: Demonstrating Management System Capability

Reviewing Management System Capability

Before EPA awards a grant to your organization, whether you are selected competitively, non-competitively, or based on your unsolicited proposal, the EPA Policy on Assessing Capabilities of Non-Profit Applicants for Managing Assistance Agreements, see EPA Order 5700.8: EPA's Policy on Assessing Capabilities of Non-Profit Applicants for Managing Assistance Awards which requires the EPA Grants Management Office (GMO) to assure your organization can be expected to meet certain management system requirements of EPA’s regulations. (The policy also requires the EPA program office that selected you project for a grant to evaluate your organization’s technical ability to manage and complete your proposed project. That evaluation is done as a part of the competitive or technical review process.)

When a program office selects an application for funding, it must notify the GMO. At that time, the GMO will assure your organization meets the management capability requirements. If the GMO has not reviewed your organization’s management capability within four years and the proposed grant amount is for $200,000 or more, the GMO will request you to fill out an EPA administrative capability questionnaire in appendix A of the EPA Order. It covers:

- Standards for Financial Management Systems;

- Standards for Property Management and Purchasing; and

- Standards for Personnel and Travel Management.

Demonstrating Financial Management System Capability

Basic requirements for Financial Management Systems are found in Section 30.21 of the Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and Other Non-profit Organizations. Additional requirements are established by the Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230)

Generally, you will have an accounting system that was developed with the assistance of a firm or person with accounting system development and management expertise or by obtaining any one of several excellent off-the-shelf software programs, and many times both. EPA requirements should not require significant changes or additions to your existing system.

This training will help assure your answers on the EPA administrative capability questionnaire are complete and accurate. The item numbers of the following training sections correspond to the question numbers on the questionnaire. Even if EPA will not be reviewing your management systems, this training will refresh your understanding of applicable EPA requirements.

Demonstrating Financial Management System Capability

Item 2 – Performance Data and Unit Cost Information

EPA’s regulation (40 CFR 30.21(a)) require that your financial management system be able to relate financial data to performance data and to develop unit cost information.

Comparing your financial data to your performance data allows you to compare estimated costs for various activities to the actual cost of carrying out the work. In this way, you are quickly alerted when your costs significantly exceed the estimates on which your grant is based. In such an event, you should notify your project officer requesting an increase in the grant to cover your revised estimate based on the more accurate information. However, EPA is not obligated to provide additional funds.

Unit cost information is an estimate of how much it costs your organization to complete a single activity, when that activity regularly recurs. For example, if a project involves taking numerous samples of a pollutant and evaluating the components, this repetitive activity may lend itself to unit costing. Such unit costing helps you to better forecast or budget the cost of the activity.

Demonstrating Financial Management System Capability

Item 3 - Complete Current and Accurate Financial Data

Section 40 CFR 30.21(b)(1) of EPA’s regulations requires that your financial management system provide accurate, current, and complete disclosure of the financial results of your grant. In other words, your accounting system must be able to separate the transactions for your EPA grant project from the transactions for your other activities. This will assist you in preparing EPA required financial reports and reports.

In accordance with the principle of consistency, transactions related to your EPA project must be treated the same as for your other project’s transactions. For example, a cost included in your overhead or indirect cost pool for general transactions must be included in the overhead or indirect cost pool for your EPA project. (An exception would occur if a cost is unallowable. It may not be charged to the EPA project either directly or indirectly. Allowable and unallowable costs are identified in Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230).

Your accounting system data must be accurate. This means the actual amount of income for the project activities must be recorded when it is received. You must similarly record the actual amount of costs as they are incurred or paid. You must not use estimates of income or costs except for budgeting purposes.

Your accounting system data must be current. All income and costs must be posted in the accounting system at or as near to the time they are incurred as possible. If your accounting system is based on when income accrues and when costs are incurred, you should assure all income and accrued costs are posted before reports covering the accounting period are prepared.

Your accounting system must include complete information. The system must record all transactions, even those unallowable under your assistance award. Unallowable costs, of course, must be identified as such and must not be charged to the EPA award.

Income that you must consider with respect to your EPA grant includes any income your organization earns as a result of the EPA grant project. EPA calls such income program income. For example, if, during your project, you produce and sell a book, the proceeds from the sale is program income. Your accounting system must track program income and ensure it is accounted for in the EPA project account. EPA should have included a term and condition in your grant agreement stating how you may use program income. Generally, based on your project officer’s recommendation, it may be used to carry out additional activities under your project, to reduce your nonfederal share of the project’s costs, or to reduce the allowable cost of the project. If your grant does not include a term and condition as to the use of program income but you earn income as a result of the grant, you should contact the project officer to obtain approval for one of the accepted program income uses. (See 40 CFR 30.24) The Project Officer should ensure the grant is modified appropriately.

Also, many non-profit organizations use volunteer services to accomplish much of their work. If you use volunteer services for your EPA grant project, a reasonable estimate of the value of those services may be allowable and charged to your project. Such costs can only be used to meet the nonfederal (matching) share.

To ensure the estimated cost of volunteer services is allowable, your organization must account for them. This means, for example, that volunteers must maintain records of the time they spend on your project and submit the time sheets to you. This requires complex record keeping explained in OMB Circular A-122.

Demonstrating Financial Management System Capability

Item 4 - Identify the Source and Application of Funds

Your financial management system must provide records that adequately identify the source and application of funds for EPA grant supported activities. You should record information on authorizations, obligations, unliquidated obligations, assets, outlays, income, and interest (40 CFR 30.21(b)(2)).

All accounting systems must identify where funds come from and how they are used. To comply with EPA regulations, funds you use for your EPA project must be identified so they can be separated from those you use for other activities both as to source and use. Generally, a specific identifier such as an account number or the grant number must be attached to accounting entries of funds related to your EPA project.

Demonstrating Financial Management System Capability

Item 5 - Property and Equipment Control

Your financial management system must provide for effective control over and accountability for all funds, property and other assets. It must also ensure that all assets are used for authorized purposes (40 CFR 30.21(b)(3).

All assets related to your EPA supported project must be recorded in your financial management system. This means that all project related assets must be identified with an identifier such as an EPA project related account number or the EPA grant number. While the accounting system will maintain the financial value of assets such as equipment, you must also assure equipment related to the project are included in your inventory as required by 40 CFR 30.34.

Demonstrating Financial Management System Capability

Item 6 - Comparing Outlays to Budget

Your financial management system must provide for a comparison of outlays with budget amounts for each award, including, where appropriate, information related to performance and unit cost (40 CFR 30.21(b)(4)).

Grants are awarded on a cost basis. That means that EPA will allow only actual (not budgeted) costs incurred for managing your grant project activities. Also, EPA is not required to cover cost overruns for your project.

In order to ensure you do not overspend on a particular activity at the expense of others so that organization is fully reimbursed for the federal share of your project costs, it is important that your accounting system provide information that is reliable for estimating costs. As required in item 2 above, you can use the unit costs information for repetitive activities that will ensure future cost estimates for similar work are reliable.

Demonstrating Financial Management System Capability

Item 7 - Expending Grant Funds Timely

Your financial management system must include written procedures to ensure there is a minimum of time between payments from the U.S. Treasury and your expenditure of the funds (40 CFR 30.21(b)(5).

When you receive an EPA grant, you will be enrolled in an electronic funds transfer process (discussed later). By signing the grant you are agreeing to receive payment electronically. In general, EPA will pay your organization on an advance basis. However, advances are based on your requests. You must request payments only if they will be disbursed in the relatively short-term future.

Demonstrating Financial Management System Capability

Item 8 - Ensuring Reasonableness of Costs

Your financial management system must provide written procedures for determining the reasonableness, allocability and allowability of costs in accordance with the Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230) (see 40 CFR 30.21(b)(6).

Reasonableness – A cost is reasonable if, in its nature or amount, it does not exceed what a prudent person would pay under the circumstances prevailing at the time the decision was made to incur the cost. Details for determining whether a particular cost is reasonable can be found in the Cost Principles for Non-Profit Organizations, OMB Circular A-122, Attachment A, A.3.

You must evaluate each cost you charge to your project to ensure it is reasonable. If you determine a cost is not reasonable, you must adjust it to a reasonable amount before charging it to your grant project in your accounting system.

Allocability – A cost is allocable to your grant if the goods or services involved are chargeable or assignable to such cost objective in accordance with relative benefits the grant receives or other equitable relationship. To be allocable, you must treat a cost consistently with other costs incurred for the same purpose in similar circumstances and it must:

- Be incurred specifically for the grant activities,

- Benefit both the grant and other work and distributed in reasonable proportion to the benefits received, or

- Be necessary to the overall operation of your organization, even if a direct relationship to any particular project activity cannot be shown.

If a cost is direct and is incurred for the work of more than one grant or activity, you must allocate the amount among the affected grants and activities based on the extent the work benefits each grant or activity.

Allowability – Certain costs, while legitimate business expenses, are not allowable under EPA grants. A primary source for determining whether a particular cost is allowable is the Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230). For example, your organization may have borrowed money to carry out some activities or buy equipment. OMB Circular A-122, Attachment B, 23. states that Costs incurred for interest on borrowed capital, temporary use of endowment funds, or the use of the non-profit organization’s own funds, however represented, are unallowable. While the Circular then explains circumstances where interest may be allowable, those circumstances are very limited.

Unallowable costs cannot be charged to EPA directly nor can they be included in your indirect cost pool.

A cost is allowable if it meets the following general criteria:

- It is reasonable and allocable to the grant.

- It conforms to limitations or exclusions under OMB Circular A-122, Attachment B (2 CFR 230), in particular. Attachment B lists many types of cost and explains whether they are allowable under grants.

- It is treated consistently with policies and procedures that apply uniformly to both EPA grant activities and other activities of your organization.

- It is recorded in accordance with your accounting system and generally accepted accounting principles (GAAP).

- It is not included as a cost or used to meet cost sharing or matching requirements of any other federally financed program.

- It is adequately documented.

Demonstrating Financial Management System Capability

Item 9 - Supporting Accounting Records

Your financial management system must assure that cost accounting records are supported by source documentation (40 CFR 30.21(b)(7).

In addition to recording financial transactions in your accounting system, you must maintain records that back up the transactions. Those records must be identified by the use of appropriate account numbers to ensure the EPA grant costs are charged to the EPA grant. Records for your grant may have account numbers that include the EPA grant number.

All costs you incur must have related records. For example, you must have time sheets that support payroll charges and contracts and contractors’ bills that support contract costs. The supporting information must be cross-referenced to the accounting entries and maintained in your filing system. If you receive volunteer goods or services, those providing the goods or services should provide you with documentation as to the value of the goods or services. In the case of volunteer personnel, the documentation should be similar to your organization’s time sheets and should not be only estimates of time spent.

Demonstrating Financial Management System Capability

Item 10 - Complying with the Single Audit Act

Your financial management system must provide procedures for conducting an audit in accordance with Audits of States, Local Governments, and Non-profit Organizations, OMB Circular A-133, if required. Currently, audits are required for recipients expending $500,000 or more in federal funds during their fiscal year (40 CFR 30.26(a)).

If your organization expends more than $500,000 in federal funds (the total from all federal agencies) in any of your fiscal years, you are subject to the Single Audit Act and you must conduct a single audit. (You are expending funds when you make payments for activities under your federal grants). The audit requirements under the Single Audit Act are complex, and this training does not cover the details of these audits.

Also, regardless of whether your organization is subject to the Act, EPA’s Office of Inspector General may audit your EPA grants. If you conduct an audit in accordance with the Single Audit Act, EPA’s Office of Inspector General may still audit your EPA grants, but it will, to the extent practicable, build on the results of your single audit.

See also the training section on preparing for audit.

Demonstrating Financial Management System Capability

Item 11 - Establishing Indirect Cost Rates

Your financial management system must provide for and describe existing or planned indirect cost rate charges and systems Cost Principles for Non-Profit Organizations, OMB Circular A-122, Attachment A, Sections C and D.

Indirect costs are costs incurred for common or joint objectives. Therefore, the costs cannot be readily and specifically identified with a particular project (your EPA grant project, for example) or activity. In order to be allowable under your EPA grant, these costs must be grouped into common pools and distributed to the grant and all other benefiting activities by a cost allocation process. Examples of such costs may be utilities, senior organization management and their support, and rent.

In order to substantiate a claim for the reimbursement of indirect costs your organization must develop an indirect cost rate proposal in accordance with the procedures in Cost Principles for Non-Profit Organizations, OMB Circular A-122, Attachment A, Sections C and D. Your indirect cost rate proposal should be based on the most current financial data supported by your organization’s audited financial statements.

EPA has developed a Sample Indirect Cost Proposal Format for Non-profit Organization to assist you in developing an indirect cost rate proposal if you do not have one. EPA also has a second, more detailed guidance document called the EPA Guide on How to Prepare an Indirect Cost Rate Proposal for a Non-Profit Organization.

You must submit your indirect cost rate proposal to your organization’s cognizant federal agency for review and approval. Your cognizant agency is generally the one that awards you the most funds. If your organization has not previously established an indirect cost rate with a federal agency, you should submit to the agency that awards you the most funds an initial indirect cost rate proposal immediately after you are advised that an EPA or other federal grant will be made and, in no event, later than three months after the grant’s effective date. (If you cannot determine cognizant agency for your organization, submit the proposal to the EPA Grants Management Office. EPA will assure your proposal is reviewed.) The cognizant agency will remain the same unless there is a major long-term shift in the dollar volume of the general awards to your organization.

The cognizant agency will negotiate any necessary changes in your proposal. The results of each negotiation will be a written agreement between your organization and that agency. If a dispute arises in a negotiation of an indirect cost rate between the cognizant agency and your organization, the dispute will be resolved in accordance with the dispute resolution process of the cognizant agency.

All agencies will accept the indirect cost rate approved by your cognizant agency.

Establishing Property and Purchasing Standards

Item 1 - Reviewing Equipment Management Systems

To receive a grant from EPA, you must have a property management system (40 CFR 30.34(f)(1)) that includes: (1) a description of your equipment; (2) an identification number; (3) the source of the equipment, including, if applicable, the grant number; (4) an indicator as to where title vests; (5) the acquisition date; (6) if applicable, the federal share of the equipment’s cost; (7) the location and condition of the equipment; (8) the acquisition cost; and (9) if applicable, ultimate disposition information (EPA often refers to equipment as property.)

EPA defines equipment as tangible nonexpendable personal property charged directly to your EPA assistance project having a useful life of more than one year and an acquisition cost of $5000 or more per unit (40 CFR 30.2(l). Sometimes, EPA loans equipment to recipients for use on grant projects. This equipment is still owned by EPA and your property management system must reflect EPA’s ownership. You may use the EPA owned equipment on activities not supported by EPA if EPA authorizes you to do so in writing.

The acquisition cost of equipment is the net invoice price of the equipment, including the cost of modifications, attachments, accessories, or auxiliary apparatus necessary to make it usable for your project. Other charges, such as the cost of installation, transportation, taxes, duty or protective in-transit insurance may be included or excluded from the acquisition cost in accordance with your regular accounting practices. Your organization may establish lower limits in your definition of acquisition cost if that would be consistent with your existing equipment management system.

Title to equipment you purchase with grant funds vests in your organization subject to EPA’s interest as stated in grant conditions or as noted below.

You may not use equipment purchased under a grant to provide services to non-federal outside organizations for a fee that is less than private companies charge for equivalent services, unless specifically authorized by Federal statute, for as long as EPA retains an interest in the equipment. You must use the equipment for the EPA project as long as needed, whether or not the project or program continues to be supported by federal funds. You may not encumber the property, e.g., use the equipment for collateral under a loan, without EPA approval.

When you no longer need equipment for the original project or program, you may use it for other federally-sponsored activities, in the following order of priority: activities sponsored by EPA, then activities sponsored by other federal awarding agencies.

During the time you use the equipment for the EPA project, your organization may make it available for use on other projects or programs if that does not interfere with the work on the EPA project. You must give first preference to other projects or programs sponsored by EPA; you may give second preference to projects or programs sponsored by other federal awarding agencies.

If it is necessary to acquire replacement equipment during the EPA project or for continuing use on the project after the EPA grant ends and, if EPA approves, you may use the equipment to be replaced as a trade-in or sell the equipment and use the proceeds to offset the costs of the replacement equipment.

Establishing Property and Purchasing Standards

Item 2 - Inventorying Equipment

Your organization must take a physical inventory of equipment and reconcile the results with your equipment records at least once every two years (40 CFR 30.34(f)(3).<;p>

You must investigate any differences between quantities determined during the inventory and those shown in the accounting records to determine the reason for the difference. During the inventory you must also verify the existence, current use, and continued need for the equipment.

Establishing Property and Purchasing Standards

Item 3 - Safeguarding Equipment

Your equipment management system must provide controls to insure safeguards against loss, damage or theft of the property (40 CFR 30.34(f)(4).

You must investigate and fully document any loss, damage, or theft of equipment; if EPA owned the equipment, you must promptly notify EPA.

Establishing Property and Purchasing Standards

Item 4 - Maintaining Equipment

Your property management system must provide for adequate maintenance of equipment (40 CFR 30.34(f)(5)). In particular, you should develop and use maintenance schedules and document repairs. Your procedures should assure the equipment is kept in good operating condition.

Establishing Property and Purchasing Standards

Item 5 - Purchasing Goods and Services

Your organization must have written purchasing procedures that assure you avoid unnecessary purchases; compare lease and purchase alternatives; and provide generally for the purchase goods and services through open competition (40 CFR 30.44(a).

EPA often calls purchasing under grants procurement, but we will use the term “purchasing” in this training.

This training covers basic minimum requirements for purchasing under your EPA grant. Detailed guidance for such purchasing can be found in purchasing supplies, equipment, and services under EPA grants.

Basic Requirements for Purchasing System

It is unlikely you will purchase the supplies, equipment, and services you need for your grant at an auction, but EPA’s purchasing guidance and requirements are designed to ensure that what you buy you get at a reasonable price in a fair and openly competitive way. Many organizations have their own purchasing requirements and systems. If you have your own system it must meet the minimum standards of the EPA regulations. If your system does not meet EPA’s minimum requirements you may amend the system to meet EPA requirements, but, in any event, you must conduct your purchasing in accordance with the minimum EPA requirements. Your purchasing system must be based on the following principles and requirements:

- You must settle all contractual and administrative issues arising out of contracts under your grant (40 CFR 30.41).

- You must ensure you do not purchase unnecessary things under your grant (40 CFR 30.44(a)(1)).

- You must evaluate whether it is more economical to lease rather than purchase equipment and supplies (40 CFR 30.44(a)(2))

- You must have written standards of conduct that apply to employees involved in purchasing (in particular, the award and administration of contracts for supplies, equipment, and services) (40 CFR 30.42).

- You must, to the maximum extent practicable, ensure open and free competition in your purchasing (40 CFR 30.43).

- You must assure the cost or price of your supplies, equipment, and services is reasonable ((40 CFR 30.45). You do this by conducting a cost or price analysis for each procurement action. You must document cost and price analyses in your files. Details for conducting a cost or price analysis can be found in purchasing supplies, equipment, and services under EPA grants.(Purchases made by competitive bidding where the award is based on a lump sum are deemed to have had an adequate cost or price analysis.)

- You must make positive efforts to use disadvantaged businesses, including small businesses, minority-owned firms, women's business enterprises, and firms in labor surplus areas, whenever possible (40 CFR 30.44(b)). You must submit reports that indicate your compliance with this requirement on EPA Form 5700.52A.

- You may copyright any software or written material that is subject to copyright and was developed, or for which ownership was purchased, under an award. EPA reserves a royalty free, nonexclusive and irrevocable right to reproduce, publish, or otherwise use the work for federal purposes, and to authorize others to do so (40 CFR 30.36)

- You must ensure you do not award a contract to any person (organization or individual) debarred or suspended or otherwise excluded from or ineligible for participation in Federal programs (40 CFR 30.13). You must also ensure your contractor does not award a subcontract to any person debarred or suspended or otherwise excluded from or ineligible for participation in federal assistance programs. You can find the list of debarred, suspended, and excluded persons at: System for Award Management.

- You must maintain records of each purchase (40CFR 30.46 and see also 40 CFR 30.21(b) and 30.53(b)). For purchases which exceed $100,000, these records must include the rationale for the method of procurement, the reason you selected the contract type, your justification for lack of competition when competitive bids or offers are not obtained, the reasons for contractor selection or rejection, and the basis for the contract price, including documentation of required price and cost analyses.

- You must ensure your contracts comply with applicable federal, state, and local law.

Contract Types

You must decide which type contract is appropriate given the circumstances of each purchase. You may use your standard contract types for contracts under your EPA grant. Contract types include:

- Fixed price contracts. Fixed price contracts are used when effective competition based on a complete product description and clear plans and specifications is likely. There should not be any significant technical or engineering unknowns. The contractor must furnish the goods or services for the fixed price, and so assumes significant risk. Profit is not stated or negotiated separately.

- Cost reimbursable contracts. You should use a cost reimbursement contract when it is not feasible to award a fixed price contract. The contractor’s cost and profit must be negotiated separately. Often, the contractor must satisfactorily complete only the amount of work equivalent to the estimated cost to qualify for the negotiated profit; the contractor may not be able to complete the entire project for the amount established. Thereby, the contractor assumes less risk than under a fixed price contract. Alternatively, you may negotiate a cost reimbursable contract that includes a ceiling which may not be exceeded but which requires completion of the work whereby the risk to the contractor is increased.

- Cost-Plus Type Contracts (prohibited). Percentage of construction cost and cost plus a percentage cost contracts provide an incentive for the contractor to increase costs in order to increase profit. These contract types must not be used.

See also the Purchasing Good and Services section of this training related to activities after award of a grant.

Applying Personnel and Travel Standards

Item 1 - Maintaining Standards of Conduct

Your organization must have written standards of conduct governing the performance of employees engaged in the award and administration of contracts (i.e., conflict of interest). The standards must provide for disciplinary actions in the case of misconduct (40 CFR 30.42).

Your code of conduct must make clear that no employee, officer, or agent of your organization may participate in the selection, award, or administration of a contract under you EPA grant if a real or apparent conflict of interest would result.

Conflicts of interest occur when your employee, officer, or agent, members of immediate families, partners, or organizations which employs or is about to employ any of these persons, has a financial or other interest in the firm selected for an award. Your officers, employees, and agents must neither solicit nor accept gratuities, favors, or anything of monetary value from contractors, or others involved in your contracts. You may, however, set standards to make clear that, if the interest is not substantial or the gift is an unsolicited item of nominal value, no conflict of interest occurs.

Your code of conduct must provide for disciplinary actions for cases where your organization’s officers, employees, or agents violate the code (40 CFR 30.42).

Applying Personnel and Travel Standards

Item 2 - Recording and Charging Payroll Costs

Your organization must have a personnel payroll and records system that can provide monthly reports on the activities of each employee who works directly on the EPA grant (OMB Circular A-122, Attachment B.8.m.). In order to support the allocation of indirect costs, you must also keep records for employees who do not work directly on the grant, but whose work includes direct work on the grant or who work on activities that will be included your organization's indirect cost pool (e.g., an employee engaged part-time in indirect cost activities and part-time in a direct function or full time in indirect activities). Further, your payroll must be based on documented pay statements approved by responsible officials.

Your personnel system must also meet the following standards:

- Reports must reflect an after-the-fact determination of the actual activity of each employee. Budget estimates (i.e., estimates determined before the services are performed) are not adequate to support grant costs.

- Reports must account for the total activity for which employees are compensated.

- Reports must be signed by the individual employee, or by a responsible supervisory official having first hand knowledge of the activities performed by the employee. The supervisor must be able to certify that the distribution of activity represents a reasonable estimate of the actual work performed by the employee during the periods covered by the reports.

- Reports must be prepared at least monthly and must coincide with one or more pay periods.

These requirements also apply to labor costs that will be used for the non-federal share of the grant.

In addition, payroll costs must be reasonable. In general, this means salaries and wages paid for work on the EPA grant must be the same as your organization pays for other work. If your organization has only federally supported work, salaries and wages must be comparable to that paid for similar work in the labor markets in which you compete for the kind of employees involved. For details on reasonableness see OMB Circular A-122, Attachment B, 8.c.

Also, overtime payroll charges generally require EPA’s prior approval. Cases where prior approval is not required are described in OMB Circular A-122, Attachment B, 8.f.

Applying Personnel and Travel Standards

Item 3 - Charging Travel Costs

Your organization must have a written standard travel policy that meets the requirements of OMB Circular A-122, Attachment B, 51.

Travel costs are the expenses for transportation, lodging, subsistence, and related items incurred by employees who are in travel status on official business. Costs may be charged on an actual cost basis, on a per diem or mileage basis in lieu of actual costs incurred, or on a combination of the two, provided the method used is applied to an entire trip and not to selected days of the trip. Travel costs are allowable subject to specific limits stated in OMB Circular A-122, Attachment B, 51. For example:

- The costs must be not exceeding charges your organization allows in its regular operations based on your written travel policy.

- Airfare costs must not exceed the lowest commercial discount airfare unless such accommodations would: (a) require circuitous routing; (b) require travel during unreasonable hours; (c) excessively prolong travel; (d) result in additional costs that would offset the transportation savings; or (e) offer accommodations not reasonably adequate for the traveler’s medical needs. Your organization must justify and document these conditions on a case-by-case basis.

Quiz:

Part 3 - Accepting a Grant

Reviewing the Grant Agreement

EPA will notify your organization that it selected your proposal for an award by sending you a grant agreement or a cooperative agreement. (Your Congressional representatives may notify you in advance). The grant agreement and cooperative agreement forms are the same, except that a grant will say grant agreement at the top and a cooperative agreement will say cooperative agreement at the top.

The difference between the two is that EPA will have substantial involvement in a cooperative agreement and EPA’s involvement will be stated in the terms and conditions of the agreement. In this training we call the document a grant agreement and mean either.

The grant agreement will include appropriate terms and conditions and it will incorporate by reference your application and supporting information and EPA’s regulations and guidance. When you sign the grant agreement, you are agreeing to abide by all of its requirements and terms and conditions, so you should review it carefully before signing.

The EPA sample grant agreement will help you follow this section of the training. It does not include the terms and conditions pages.

Reviewing the Grant Agreement

Budget

The budget or grant amount in your grant agreement may have been changed from those in your application. Changes are made because, among other things, EPA may have determined certain costs unallowable, your request may have exceeded the EPA funds available, or your proposed cost share was less than required.

Your project officer should have negotiated all changes with you, but you should review the EPA amount offered and the revised budget to assure you can carry out the project within the budget and without additional EPA funds.

It is likely that your grant will require you to provide cost sharing or matching funds. Cost sharing or matching funds can only from allowable costs under your grant. You cannot use funds spent under another grant to cost share or match your EPA grant, unless a law specifically authorizes you to.

You may use the value of donated goods and services only for cost sharing. As stated in the section on complete, current, and accurate cost data, the requirements for valuing donations are complex and are explained in OMB Circular A-122, Attachment B, 12.

Even if your review is complete, the fact that EPA approves your grant does not ensure EPA will allow the cost of all activities or purchases you make under the grant, even if the activities and purchases are identified in your application. If, at any time, EPA finds that an activity or purchase is not necessary or does not comply with EPA regulations, EPA may disallow the cost. This authorizes EPA to disallow the cost of a contractor, for example, even if EPA approved your grant application that indicated you would be using the services of a contractor, if, for example, EPA subsequently determined you did not obtain the contractor’s services in accordance with EPA’s minimum standards.

Reviewing the Grant Agreement

Budget Period

You should review the budget period and project period included in the grant agreement. Generally, it will be the same as the one you included in your application, but there the project officer may have negotiated a change with you or the grant award may have been delayed. Be certain the time indicated is adequate to cover the time you expect to work on the project and that it includes the time during which you may have incurred costs before EPA awarded the grant.

If it is not, or if you incurred costs for the project before the beginning of the budget period, you should contact the EPA project officer to discuss an amendment. Sometimes such minor changes are agreed to before you sign the grant agreement. In such cases, the EPA Grants Management Office will revise the grant agreement and send the revision to you before you accept the grant. In other cases, the project officer will ask you to sign and return the grant agreement and then request an amendment.

Reviewing the Grant Agreement

Terms and Conditions

Your grant agreement will likely include three types of terms and conditions:

Administrative – Administrative terms and conditions involve such things as payment, applicable regulations, statutory requirements and required administrative reports.

Programmatic – Programmatic terms and conditions include the timing and content of progress reports, an explanation of substantial involvement for cooperative agreements, and special performance requirements.

High Risk – High risk terms and conditions include things such as requiring: reimbursable payment as opposed to advance payments; EPA approval at one stage of the project before you are allowed to advance to the next; intense EPA monitoring; and more detailed financial reports.

Your organization may be found to be high-risk if EPA has determined that you may:

- Have a history of poor performance.

- Be financially instable.

- Have management system deficiencies.

- Have failed to follow terms an conditions under previous grants.

- Be deemed irresponsible for other reasons.

These requirements are found in 40 CFR 30.14.

Reviewing the Grant Agreement

Acceptance

If you have significant problems with or you find mistakes in the grant agreement, including the terms and conditions, discuss them with your Project Officer as soon as possible.

When you are satisfied with the grant agreement, including the terms and conditions, your organization’s authorized representative should sign it and return a copy to EPA.

The grant agreement becomes a binding agreement between you and EPA when you sign it. You cannot obtain payments until EPA receives the signed agreement.

Quiz:

Part 4 - Managing Grant Activities

Making the Project a Success

Your Project Officer will not dictate how you should manage the project. The project officer will give advice and assist you where possible, but the project is yours to pursue. While the administrative requirements are important, the outcome of your project is the most important aspect of your grant. Proceed as you have proposed and complete the project in an orderly fashion.

If, at some point, it becomes clear that you must change the direction or focus of your project or that it cannot be completed with the funds available, contact you project officer, explain the needed changes, and request an amendment, if necessary.

In the case of a cooperative agreement, the terms and conditions may require you to obtain the project officer’s approval after completing a task before you proceed with a subsequent task or that you notify your project officer when you complete a task to allow for the project officer’s input as appropriate.

Complying With Terms and Conditions

The terms and conditions of your grant agreement will cover requirements relating to such things as reporting, payment, minority and women owned business enterprise use, payments to consultants, and lobbying.

If EPA has found that you are a high-risk organization (40 CFR 30.14), the terms and conditions may include additional extra requirements directed at protecting EPA from the weaknesses it has identified in your administrative systems. One example would be limiting you to reimbursement payment as opposed to advance. In such a case, the grant agreement will explain the reasons for having found you to be high-risk and establish the changes or corrections you will have to make to change the designation.

Your grant agreement will include numerous terms and conditions. They will cover such things as:

- Filing federal financial reports.

- Using minority and women owned business enterprises.

- Submitting quarterly progress reports.

- Complying with the Prompt Payment Act.

- Submitting final technical reports.

- Limiting lobbying.

- Avoiding debarred parties

Purchasing Goods and Services

If your organization has a purchasing system consistent with the requirements of the purchasing section of this training, and you follow that system when purchasing goods and services, you will be doing what is required.

You should notify your project officer if:

- You expect a purchase to exceed $100,000 and you are awarding the contract without competition or you received only one bid or offer in response to a solicitation.

- You expect the purchase to exceed $100,000 and you are requiring the bidders to supply a brand name product.

- You intend to award a contract that exceeds $100,000 to other than the apparent low bidder.

- You intend to modify the scope of a contract or to increase the contract amount by more than $100,000.

Achieving Environmental Results

Your interim and final performance reports required by 40 CFR 30.51 must address progress in achieving agreed-upon outputs and outcomes. If appropriate, your reports must explain why outcomes or outputs were not achieved.

Requesting Payments

EPA makes payments for grants by way of Electronic Funds Transfer (EFT) or through the Department of Treasury’s Automated Standard Application for Payments (ASAP). When you accept a grant, you agree to use one of these electronic methods to request and receive payments. Upon acceptance, the Las Vegas Finance Center (LVFC), the EPA's payment and financial reporting office for grants, will contact you regarding your ability to drawdown funds, either using EFT or ASAP.

When EPA awards your grant, an EPA financial management office will contact you about how to enroll in Automated Standard Application for Payments (ASAP), if you are not already enrolled.

The preferred method of payment for EPA grants/cooperative agreements is ASAP. ASAP enrollment is highly encouraged for organizations that have multiple grants/cooperative agreements and for those with a frequent need to request funds. If your organization uses multiple bank accounts for EPA grants/cooperative agreements, you must enroll in Automated Standard Application for Payments (ASAP).

If you are enrolled or will be enrolled in ASAP when you affirm (accept) your grant, EPA will enter a spending authorization into the ASAP account. You will request payment through an on-line connection with ASAP. (If a financial institution is acting as the agent of your organization, that institution may request your payment through the Federal Reserve's FEDWIRE system.) You will generally receive your payment the next day or on a future specified day (up to 32 calendar days from the date of the payment request). In emergency instances, EPA also has the ability to issue same day payments.

Although ASAP is the preferred payment method, EPA may pay you via Electronic Funds Transfer (EFT).

- Should you elect to have payments processed via EFT, for those required to register with the Central Contractor Registry (CCR), the Las Vegas Finance Center (LVFC) has already obtained your organization's banking information in conjunction with our registration. Those not required to register with CCR must file your organization's banking data with LVFC. You do this by completing the ACH Vendor/Miscellaneous Payment Enrollment Form, SF 3881 and faxing it to the LVFC to 702-798-2423.

- For organizations that choose the EFT method of payment, you will need to complete the EA Payment Request Form and fax it to LVFC every time funds are required by your organization.

- All required financial forms can be located at the Financial Services resource directory.

Since EPA makes payments promptly, you should request payment only for the amount you need to meet immediate cash requirements. You should then disburse the funds as soon as possible after receiving them. (Please see Cash Management Requirements before you submit requests for payment.)

You should also ensure subrecipients are only requesting funds for their immediate needs, also. If you or your subrecipients do not comply with these requirements, EPA may place your organization on the reimbursement payment method.

Monitoring Your Award

Grantees are responsible for managing the day-to-day operations of their grant. To fulfill your role in regard to the stewardship of federal funds, EPA awarding offices monitor grants to identify potential problems and areas where technical assistance might be necessary. This active monitoring is accomplished through review of reports and correspondence from the grantee, audit reports, site visits, and other information available to EPA.

Amendments and Revisions

If it becomes necessary to significantly change your grant activities, you must obtain EPA approval.

You must obtain the award official’s prior written approval (in the form of a grant amendment) in accordance with 40 CFR 30.25(c)(1) for:

- A change in the scope or the objective of the grant project (even if there is no associated budget revision that requires prior written approval).

- A change that requires additional EPA funding.

- Costs that require prior approval in accordance with Cost Principles for Non-Profit Organizations, OMB Circular A-122 (2 CFR 230).

- Pre-award costs incurred more than 90 calendar days prior to award.

You must obtain your project officer’s approval (generally in the form of a letter) in accordance with 40 CFR 30.25(c)(2) for:

- A change in a key person specified in the application or award document.

- The absence of the approved project director or principal investigator for more than three months or a 25 percent reduction in time devoted to the project.

- The transfer of amounts budgeted for indirect costs to absorb increases in direct costs, or vice versa.

- The transfer of funds allotted for training allowances (direct payment to trainees) to other categories of expense.

- Unless described in the application and included in the Grant Agreement, the subaward, transfer or contracting out of any work under an award. (This provision does not apply to the purchase of supplies, material, equipment or general support services.)

You may make other changes without EPA approval. For example, you may:

- Extend the expiration date of the award one time for up to 12 months, if:

- The terms and conditions of the award do not prohibit the extension.

- The extension does not require additional federal funds.

- The extension does not involve any change in the approved objectives or scope of the project.

- You notify the EPA award official in writing with the supporting reasons and revised expiration date at least 10 days before the expiration date specified in the award. (You may not use this one-time extension merely for the purpose of using unobligated balances.)

If you have a question about whether a change requires EPA prior approval, it is best to contact your project officer to discuss the proposed change.

Remedies for Noncompliance

EPA recognizes that not all projects will meet the goals established in statements of work. If your project does not meet its goals, but your organization has followed the work plan and made appropriate efforts to complete the project, it is unlikely that EPA will take adverse action. You must, of course, make every effort to keep the project officer advised of your efforts and results.

On the other hand, if you have not made appropriate efforts or you fail to comply with terms and conditions of the award, EPA may terminate your project for cause (40 CFR 30.61(a)(1)). EPA may also terminate your grant, if you and EPA agree it is for the best interest of those involved (40 CFR 30.61(a)(2)).

You may terminate your grant by sending EPA written notice stating the reasons for the termination and the effective date of the termination (40 CFR 30.61(a)(3)).

If EPA terminates your grant, EPA and your organization may agree that EPA will allow certain costs. In that case, you and EPA must also agree on any continuing responsibilities, such as property and equipment management, you may have after the termination.

Subgrants

Some grant projects include activities under which your organization will make subgrants to other organizations or individuals. A subgrant is an award of money or property in lieu of money made to an eligible organization or individual. A subgrant includes money or property you make available by any legal agreement, even if the agreement is called a contract. It does not include purchased goods and services nor does it include: technical assistance, which provides services instead of money; other assistance in the form of loans, loan guarantees, interest subsidies, or insurance; direct payments of any kind to individuals; and, contracts which are required to be entered into and administered under your purchasing system.

Disputes

Disagreements between EPA staff and your organization may arise during or after your grant. It is EPA’s goal to resolve disputes at the lowest level possible, but if you cannot reach an informal agreement with EPA staff, you should request a written final decision from an EPA disputes decision official. The EPA disputes decision official is the individual designated by the Award Official to resolve disputes concerning grants.

The disputes decision official will provide a written final decision concerning the dispute. The final decision will explain in detail the reasons for EPA’s position.

The disputes decision official decision will be the final EPA decision unless you request a review of the decision by registered mail, return receipt requested, within 30 calendar days of the date of the decision. You must send you request to the assistant administrator for the program under which your grant was awarded or the regional administrator, as appropriate. You request must include:

- A copy of the EPA disputes decision official's final decision.

- A description of the issues involved based on your understanding.

- A concise statement of your objections to the dispute decision official’s final decision.

You may be represented by counsel and you may submit documentary evidence and briefs for inclusion in a written record. You will be given the opportunity for an informal conference in person or by telephone with EPA officials. Based on the information available and EPA’s regulations and policy, the regional or assistant administrator will issue EPA’s final decision.

An assistant administrator’s decision to confirm a headquarters disputes decision official’s final decision will constitute final Agency action.

However, a regional administrator’s decision to confirm a regional disputes decision official's decision will constitute the final agency action unless you submit a petition for discretionary review by the assistant administrator responsible for the assistance program within 30 calendar days of the regional administrator's decision.

You must send the petition to the assistant administrator by registered mail, return receipt requested. The request must include:

- A copy of the regional administrator's decision.

- A concise statement of the objections to the decision.

If the assistant administrator decides not to review the regional administrator's decision, the assistant administrator will advise you in writing that the regional administrator's decision remains the final agency action. If the assistant administrator decides to review the regional administrator's decision, the review will generally be limited to the written record on which the regional administrator's decision was based.

Quiz:

Part 5 - Closing the Grant

Submitting Final Reports

Your grant agreement will include a term and condition related to your final technical report. The project officer may have prepared a final technical report term and condition that gives specific instructions as to the content of the report. If not, at a minimum, the final technical report must include (40 CFR 30.51).

- A comparison of actual accomplishments with the goals and objectives established for the project, the findings of the investigator, or both. Whenever appropriate and the output of programs or projects can be readily quantified, such quantitative data should be related to cost data for computation of unit costs.

- Reasons why established goals were not met, if appropriate.

- Other pertinent information including, when appropriate, analysis and explanation of cost overruns or high unit costs.

EPA will not require you to submit more than the original and two copies of your final technical report.

Item 2 - Final Federal Financial Report

When your project is complete, you must submit a final Federal Financial Report (FFR) (SF 425). For a final FFR, your total unliquidated obligations (Line f) must be zero. This will ensure the reported final unobligated balance is correct. The unobligated balance (Line h) is the amount EPA will deobligate.

Instructions for SF-425, Federal Financial Report

If the total federal share of net outlays is less than the amount you have received through ASAP payment process, you must repay the excess. You will find instructions as to how to do this in the payment section of this training.

Item 3 - Lobbying

Your organization must certify that it did not use EPA funds under its grant to engage in lobbying of the federal government or in litigation against the United States unless authorized under law, as required in EPA's annual appropriations act. You make this certification by submitting EPA Form 5700-53, Lobbying and Litigation Certificate. You must submit the certification in accordance with the instructions provided by the EPA award official. The certification is due 90 days after the end of the project period. If any EPA funds were used for lobbying, EPA may disallow all project costs.

Preparing For Final Audit

As stated in the Single Audit Act section of this training, your organization is subject to the requirements of the Single Audit Act. This means that you must conduct an audit of your organization annually if you receive more than $500,000 per year of Federal funds.

In any case, however, you may be subject to an audit by EPA’s Office of the Inspector General (OIG). If you conducted a Single Audit the OIG audit will build on the results of the Single Audit.

To assure you are prepared for an OIG audit after the project you should assure your records are complete, your accounts are accurate, that you have complied with all Terms and Conditions of your grant, and that you have met EPA’s regulatory requirements.

You must keep the records for your EPA grant project for three years from the date of submission of your Final Federal Financial Report (SF-425) or, for awards that are renewed quarterly or annually, from the date of the submission of the quarterly or annual financial report, as authorized by EPA (40 CFR 30.53). There are a few exceptions:

- You must keep the records longer if any litigation, claim, or audit is started before the expiration of the 3-year period. See EPA’s Record’s Management Site. Your must retain your records until your resolve all litigation, claims or audit findings involving the records and you have taken final action.

- You must keep records for real property and equipment acquired with Federal funds for 3 years after final disposition.

- When you transfer your records to EPA or EPA maintains your records, you may dispose of your copies of the records consistent with your records management system requirements. These transfers occur when the records possess long-term value (under the Superfund program, for example). In such cases, in order to avoid duplicate recordkeeping, EPA may make arrangements for you to retain any records that are continuously needed for joint use.